Inflation and Your Interest Rates

If you saw our previous article about common finance terms and have been watching the news, you may have a few questions, like how exactly do we work out inflation? What does all of this mean for my interest rates? What can I do about rising inflation?

Hopefully, we can help you understand some of the basics and give you some help!

So, what exactly is inflation?

What is the CPI, and how does it work?

To understand how inflation is calculated, you need to know what the CPI is.

The CPI (Consumer Price Index) is a metric that the Australian Bureau of Statistics (ABS) determines. They do it four times per year or once per quarter. It’s conceptualised as a basket of groceries the average Australian shops for every week, but that’s not exactly true.

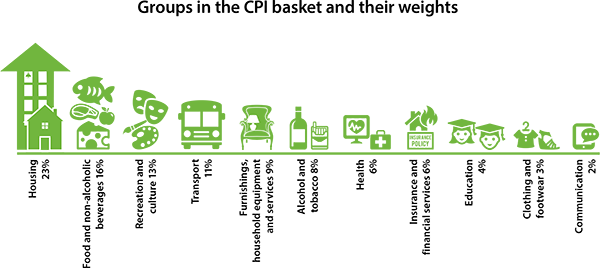

Actually, it includes a host of products and services that are broad enough that most Australian families have access to and are likely to use regularly. A lot of work goes into determining what should be included and what weighting it’s given. The weighting represents what portion of your total expenses are spent on each grouping.

This figure, from the Reserve Bank’s website, gives weight to the various expenses included in the CPI. As you can see, it’s expected the average household will spend 23% of their expenditures on housing, but only 2% on communications.

So, to determine the CPI, the Australian Bureau of Statistics will track the price of thousands of products and services, calculate their increase from the previous quarter, and multiply it by the weighting. Over the whole CPI, the total weighting adds up to 100%, so they end up with a figure representing how much more people are expected to spend.

Roughly every five years, the ABS changes the weighting of the items in the CPI, which can drastically change the outcome of their work. It’s essential because Australians change their spending behaviour to reflect new technologies and more efficient lifestyles.

There are two other figures for inflation that we look at, called weighted median and trimmed mean. They are simply a less volatile figure, without the extreme pricing swings on certain items due to supply shortages and other effects. It’s interesting to look at, especially when they’re very different from the headline inflation we often see.

The ABS publishes a list of limitations of CPI, which is to say it’s not a perfect way of describing inflation, but it is very useful! So, the takeaway here is headline inflation is a solid indication of just how much the average Australian family will experience price rises, but it’s not always the whole story.

Inflation is pretty straightforward, but how does it impact interest rates?

Inflation and interest rates.

If you read our article on the changing cash rate, you may be wondering – how does rising inflation cause a rise in interest rates?

As we mentioned, the Reserve Bank of Australia (RBA) controls the cash rate, which is their primary tool for “applying downwards pressure on inflation”. This simply means that they raise the cash rate to lower inflation.

How does this work, and how does it affect you?

The cash rate is how much interest your bank pays to borrow the money they lend you. So, to make their profit on your loan, they raise their interest rates – meaning you pay more on your mortgage or loan.

Since your bank also uses your long-term deposits to fund other loans, rising interest rates also benefit those who keep savings with their bank – providing higher interest returns.

The overall effect becomes a financial landscape where it is easier to save and harder to borrow, which according to the monetary policy used by the RBA, will lower inflation.

So, when you wonder, why does inflation make me pay higher interest rates on my variable home loan? It’s the indirect effect of the RBA trying to lower inflation with a higher cash rate.

But what can you do to improve your situation when the RBA intends to continue to increase the cash rate?

What to do about rising inflation?

If you’re on a variable interest rate home loan, the rising cash rate can, over time, have a significant impact on your minimum repayments. Minimum repayments are just the minimum amount you need to pay to cover the cost of your loan within the loan term.

o, if the rate is bound to increase, as it has been reported, then paying more now will greatly affect how much you will need to pay down the track.

If you can pay more than your minimum payment, you can ease the pressure you may feel down the track.

So, now is an excellent time to look at your expenses. What can you cut back on? Where can you save? It’s the right time to reassess your budget. Try out our calculators here, and see what increasing your current payments can do to decrease your minimum payments down the track.

And as always, talk to a financial advisor to see what you can do to improve your situation.

Need some Advice about loans?

A mortgage broker can help you find the right loan and secure the finance that’s most suitable for you. It will also ensure you avoid making mistakes.

Any questions you may have regarding loans, contact Annette Tothill on 0420 973 551.