Buy Now Pay Later and what you need to know about updates to your credit rating

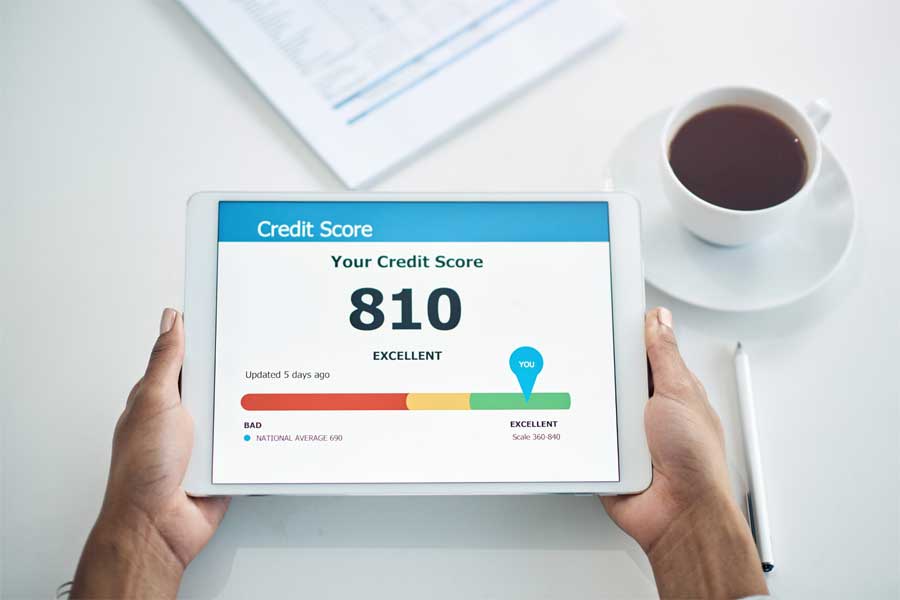

Most of us are familiar with what a credit rating or a credit score is. It is a number used to represent your reputation as a borrower and it is calculated using many different factors but some of these can include your previous borrowing history, credit profile and past credit applications. When applying for finance, banks will take into account your credit rating and this can impact whether or not you get finance approval.

In recent years there has been an explosion in the use of Buy Now Pay Later (BNPL) services such as Afterpay, Zip Pay etc. They are extremely easy to use and their popularity has soared. These services are much like the Layby of old except that BNPL is all electronically based and can be used online as well as in-store. Quick and easy to use, BNPL allows the customer to purchase goods or services straight away and delay payment spreading out their repayments over several weeks or sometimes longer. While this makes a very attractive and convenient option, especially at this time of year when we are all spending for Christmas, there can be a downside to using these services.

As of November 2021, BNPL services and Telecommunications providers will now be engaging in comprehensive credit reporting. What this means is that if you miss a payment, are late with a payment or have a default, it will have an impact on your credit rating – and don’t forget the late fees as well. These negative scores can stay on your credit score for anywhere from 2-7 years, depending on the amount involved and the type of infringement.

If you are thinking about using a BNPL service, there are ways in which you can utilise them responsibly:

1. Limit the number of BNPL accounts you open

2. Make a budget and stick to it so you don’t over spend

3. Link to a debit card instead of a credit card so as to minimise interest repayments

4. Consider setting up payment reminders

5. Read the terms and conditions carefully before signing up.

As always, Annette and her team are happy to answer any questions you may have regarding your credit rating and how you can improve it before applying for finance. Annette would like to thank Pasha from CRS Solicitors for keeping our team updated on this important information.

Need some Advice about loans?

A mortgage broker can help you find the right loan and secure the finance that’s most suitable for you. It will also ensure you avoid making mistakes.

Any questions you may have regarding loans, contact Annette Tothill on 0420 973 551.